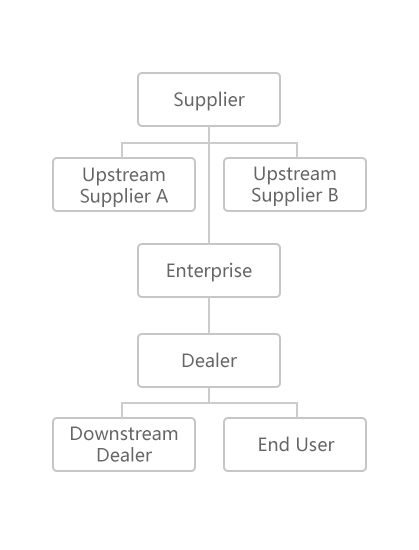

The SME supply chain finance is based on the upstream, mid-stream and downstream enterprise at their procurement of purchasing and sales parts. It provides online financing application to the clients who have demand for those financing timely. We provide more convenient and faster supply chain comprehensive services to our customers.

Types:

Types:

◆ Supplier Financing Products:

● Bank Acceptance Bill Discount

● Commercial Acceptance Bill Discount

● Order Financing

● Receivable Fianncing

◆Buyer Financing Products:

● Core Enterprise Guarantee Financing

● Core Enterprise Trade-in Financing

● Operating Loan

● Corporation Overdraft

◆Supply chain core enterprise guarantee, and other guarantee methods such as property mortgage、margin pledge、financial products pledge can be chosen.

◆ Payment can be the capital flow of supply chain, and also other income of the borrower.

◆ Different kinds of payment methods can be set up based on the supply chain capital flow. Also, customers can borrow and pay back at any time.